While the global chip crisis is on the top of the agenda of many industries, US Speaker of the House Nancy Pelosi recently visited Taiwan, which has upset China. In a series of statements, China has made it clear that Taiwan buddying up with the US would be addressed.

Taiwan island accounts for 92% of advanced semiconductor material manufacturing and nearly 63% of the global chip-making market share. Taiwan has relied on its dominance of the microchip industry for its defense. The “silicon shield” theory argued that because its semiconductor industry is so important to Chinese manufacturing and the United States consumer economy, actions that threaten its foundries would be too risky. However, the Taiwan Semiconductor Manufacturing Company (TSMC) is generally considered to be the largest microchip manufacturer in the world. Taiwan Semiconductor currently dominates the market in the production of the most advanced types of semiconductor chip There are fears that the semiconductor industry, which is very exposed to geopolitical tensions in Taiwan, will become collateral damage should China steps up pressure on Taiwan.

“Dealer lots are empty,” said Jessica Kelly, who has spent more than 20 years in the automotive industry, most recently as the senior director of offering management in advanced driver-assistance systems at NI (National Instruments). “I’ve never seen anything like this before.”

Speaking at the Future Compute conference hosted by MIT Technology Review, Kelly outlined the varied roots of the semiconductor chip shortage, its effects on the auto industry and beyond, and how companies are adapting as the shortage persists.

This story holds near-universal value given so many sectors of the economy rely on microchips. “We’ve had to figure out what we can we do to get out of this situation, but we’ve also had to think longer-term so we don’t find ourselves back here,” she said. “That means looking at different ways to produce, more efficient ways to produce, different ways to design the product.” The problem: high demand for a timeintensive product No single cause accounts for the microchip shortage. COVID-19 has had an outsized effect on the problem, as factories and ports closed while millions of people worldwide established home offices. But other contributors include labor shortfalls, lack of raw materials, trade tensions, and the growth of 5G electronics, which require more chips than previous generations of devices.

Microchip assembly comprises roughly 700 steps over a 14-week period. All these supply chain issues rest on a more foundational constraint: the process of fabricating crystals for silicon wafers, which are used in microchips. These grow at a fixed rate, and though microchip assembly comprises roughly 700 steps over a 14week period, the bulk of this time is tied up in waiting for crystals to grow. “It’s physics. You can’t speed it up,” Kelly said. “You can add more people. You can add more equipment. But if you don’t have that front-end product to supply to the back end, then you’re not going to get anywhere.”

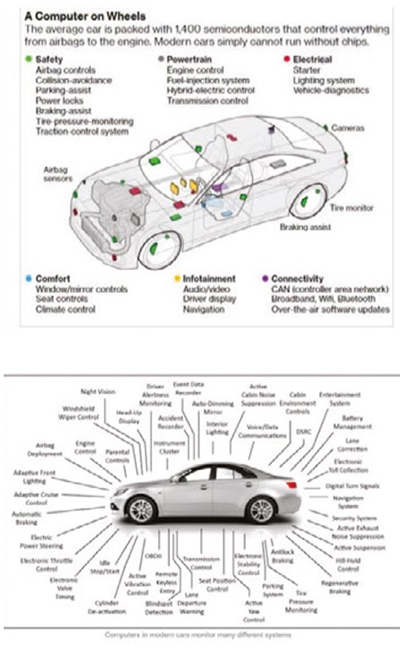

For the automotive industry in particular, this challenge has been complicated by the fact that as regulatory and consumer pressures make cars ever smarter, they rely on a growing number of electronics. At the same time, the industry only uses 5% to 10% of annual semiconductor production; most chips go to consumer electronics. Once car companies began to restart idle assembly lines and ramp up production, they found themselves at the back of a long queue.

“So, what do you do?” Kelly said. “You can’t just say, ‘I’m sorry, customer. I can’t give you anything.’”

Most immediately, companies are taking whatever microchips they can get and then building more adaptive manufacturing processes to deal with the obstacles that arise from this indiscriminate approach. If a machine on the assembly line is designed to handle chip components that arrive packaged a certain way, for instance, but all that’s available are components from a different supplier with different packaging, then companies will scoop up the available supplies and retool their machine to handle the new product. Companies are also looking into ways in which rewriting software might patch some of the shortage; perhaps code can be rewritten in such a way that a single chip can do more work than it formerly did. Expedited shipping is also an area where companies have been forced to get innovative. “I have, unfortunately, seen helicopters land in a parking lot to take a product from A to B,” Kelly said. Finally, when necessary, car manufacturers are simply delivering products without the full array of features. A rearview camera might ship without augmented reality; USB ports might be missing, or hands-free driving limited. This final option, though, is often paired with the possibility of component installation down the line.

“Can it be produced without the component and then added later — so rework, repair, retrofit?” Kelly said. “This, admittedly, presents a huge cost: Not only are these companies paying labor, but then they have to take the car back into the facility and do the underlying calibration.” Finally, in the long term, Kelly noted the trend among companies like Intel, which is looking to both redesign semiconductors to be less dependent on certain critical resources while also building new fabrication plants in the U.S. for localized production. (A vast majority of chips are made in Taiwan.)

There have been calls for government funding for new chip manufacturing companies in the U.S., and a group of investors has established a nonprofit venture capital fund, America’s Frontier Fund, to invest in chip-making in the U.S. This “reshoring” is happening not only in the U.S., but in regions around the world hit by the microchip supply shock, Kelly said. In the end, rapid and innovative responses have been able to bolster the auto industry against the most catastrophic effects of the microchip shortage. But Kelly said she does not expect the crisis to go away anytime soon — 2023 if we’re lucky, she suggested.

“Until we can stabilize the amount of supply out there, we’re going to continue to see these effects,” she said. “I would love to say by the end of this year, we’re going to see normal. We aren’t.”

Volvo Cars, one of Europe’s top car brands, says it’s past the worst of a chip supply crunch that placed a tremendous squeeze on auto production.

The company’s semiconductor inventory is now “back at fully supply,” CEO Jim Rowan told CNBC’s “Squawk Box Europe.” “We had guided in the first quarter we were affected by one specific semiconductor which hampered production across most of our range,” Rowan added.

“We had forecasted by and large we would be through that by the end of the second quarter, and that’s what we’ve seen. We are through those semiconductor issues.” Semiconductors have been in short supply for the better part of the last two years due to a litany of issues with global supply chains caused by the Covid-19 pandemic. This took a toll on the auto industry, which has become increasingly reliant on semiconductors to control everything from the braking system to more high-tech features like interactive displays.

Volvo Cars, which plays in the more luxury end of the automotive sector, posted a mixed set of second-quarter results . The firm saw a 27% slump in retail sales, with 143,006 units sold in the three months through to June, and a 2% drop in revenues to 71.3 billion Swedish krona ($7 billion). The automotive industry has likely been impacted the most by the chip shortage. Depending on its level of connectivity, the average car can have more than 100 chips on board, with many vehicles requiring thousands of semiconductors to control safety features, the electrical and powertrain systems, infotainment, connectivity, and more.

As TSMC spokesperson told, the roots of the industry’s current chip challenges date back to 2018. Everything was becoming connected, from packaging to refrigerators, and smartphone demand was skyrocketing, but demand for cars was soft. To meet the need, semiconductor manufacturers began allocating more supply of now-critical automotive components like MCUs to other industries. This became a huge problem when car demand jumped unexpectedly in the last quarter of 2020 and continued through the first half of 2021 thanks to low interest rates and consumers having more expendable income than they anticipated.